FINANCING AVAILABLE

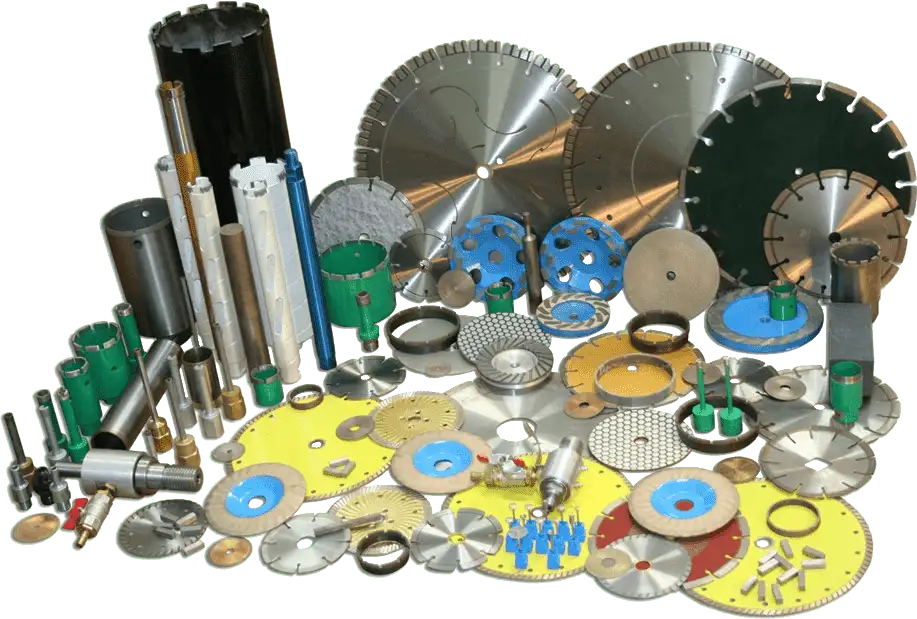

At UKAM Industrial Superhard Tools, we are committed to providing comprehensive solutions to meet your needs Understanding that purchasing advanced tools and equipment can be a significant investment, we offer flexible financing options to enable easy acquisition.

Why Use Financing?

1. Improved Cash Flow Management

Financing allows businesses to maintain their cash reserves by spreading the cost of expensive equipment over a period of time. This can help manage cash flow more effectively, allowing funds to be allocated to other critical areas such as operations, marketing, and R&D.

2. Access to Better Equipment

Financing can enable businesses to acquire higher-quality or more advanced equipment that might otherwise be unaffordable if paid for in full upfront. This can lead to improved productivity, efficiency, and the ability to stay competitive in the market.

3. Budget Flexibility

Monthly payments through financing plans allow businesses to budget more effectively. Knowing the exact amount to be paid each month helps in planning and forecasting financial commitments more accurately.

4. Tax Benefits

In many cases, payments made towards the financing of equipment can be deducted as business expenses. This can reduce the net cost of leasing or financing the equipment. It's advisable to consult with a tax professional to understand how to fully leverage potential tax advantages.

5. Avoiding Obsolescence

For industries that experience rapid technological advancements, financing can provide a way to update to the latest equipment without the burden of owning outdated technology. This is particularly relevant in fields like microelectronics and advanced material processing where cutting-edge technology can significantly influence outcomes.

6. Preservation of Credit Lines

Using specialized financing options such as Affirm or APPROVE for equipment purchases keeps other sources of credit available for different uses. This can be beneficial in maintaining financial flexibility and operational security.

7. Immediate Return on Investment (ROI)

By financing, businesses can start using the equipment immediately without waiting to accumulate the necessary funds, potentially generating revenue from the use of the equipment which can then be used to pay for its cost over time.

8. Customizable Financing Terms

Financing solutions often offer customizable terms, including the length of the finance period, down payments, and buyout options. This flexibility can help tailor the financing to suit specific business needs and goals.

9. Ease and Convenience

With options like instant approvals and minimal up-front costs, financing plans can be more convenient than traditional purchasing routes. Online management of financing also adds to the ease, allowing businesses to apply and monitor their financing directly from their offices.

Affirm Financing

Make your purchases more manageable with Affirm. Opt for easy monthly payments over 6, 12, or 24 months at competitive interest rates. This option does not impact your credit score for eligibility checks and offers an instant decision on approval, making your purchasing experience seamless.

MAKE EASY MONTHLY PAYMENTS OVER

6, 12, OR 24 MONTHS

Checking your eligibility won't affect your credit.

HOW DOES IT WORK?

Get a real-time decision.

Rates are between 0-36% APR. A down payment may be required. Subject to eligibility check and approval. Payment options depend on your purchase amount. Estimated payment amount excludes taxes and shipping fees. Actual terms may vary. Payment options through Affirm Are provided by these lending partners: affirm.com/lenders Visit affirm.com/help for more info.

APPROVE for Equipment Financing

For larger equipment needs, we provide financing through APPROVE—a network that connects with various top lenders. This platform offers a tailored financing experience, ensuring you find the best terms suited to your business's financial profile. APPROVE's innovative technology and dedicated finance team ensure a smooth and efficient financing process, from application to approval.